PAPER AND CARDBOARD, THE GOLD STANDARD OF SUSTAINABILITY

Paper and cardboard is a material that has undergone a significant revaluation as a raw material in recent times.

Sustainability awareness and changes in habits after the public health crisis are two of the determining factors that have led this humble material to be at the centre of world exports and imports right now.

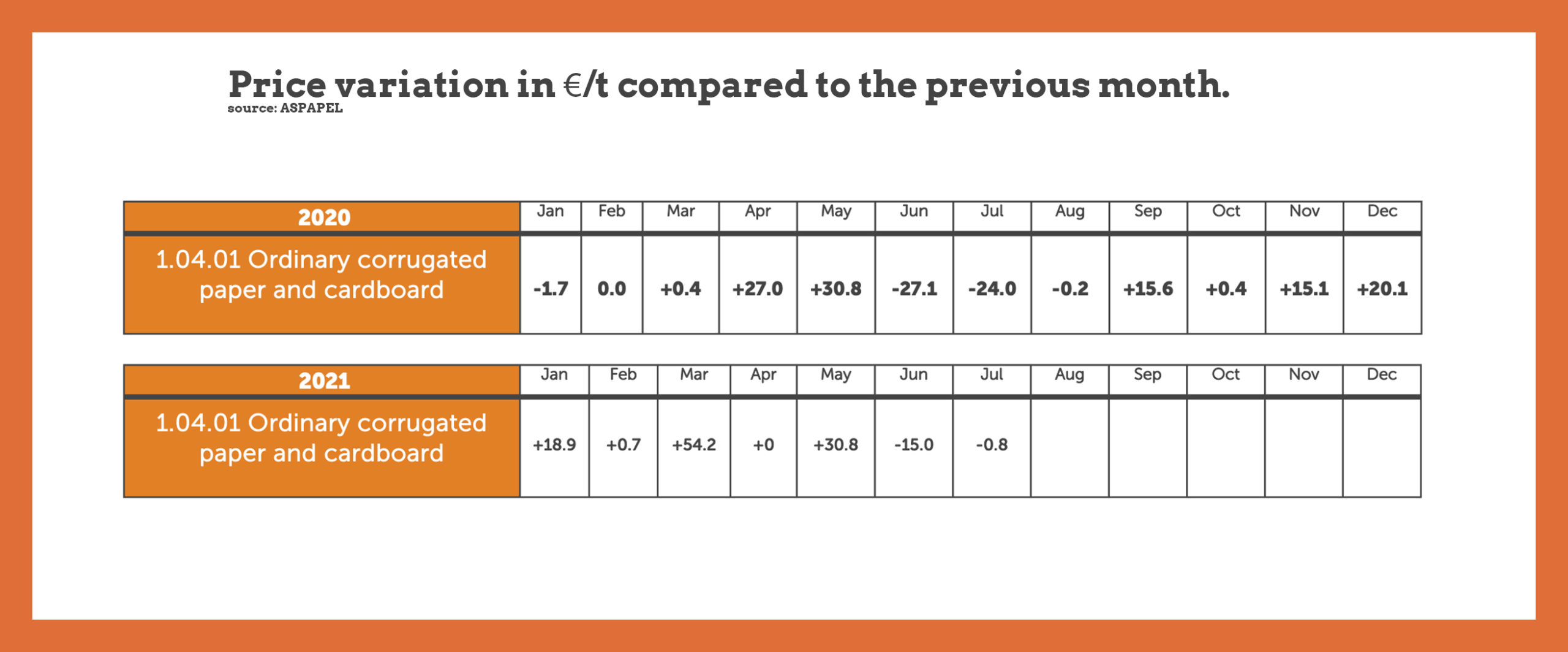

Since the end of 2020, paper and cardboard prices have risen a few times.

The statistics on prices of paper for recycling in Spain published by ASPAPEL (Spanish Association of Pulp and Paper Manufacturers) show a highly variable fluctuation between 2020 and the first half of 2021.

Here’s a brief explanation to understand these statistics: the prices shown are in euros per tonne of material classified and packed for recycling, and they are the prices that the pulp or paper manufacturer pays for the raw material.

The greater the scarcity of paper for recycling, the higher the price that must be paid for it. This is shown in the graph, which shows the price fluctuation of one month compared to the previous one.

It’s the simple law of supply and demand that has been reflected in a similar way in all European countries.

There are three main causes of this fluctuation:

- Chinese imports.

- New lifestyle and hygiene habits after COVID-19.

- Sustainability awareness and all of the plans to reduce plastic consumption.

THE CHINESE CASE

China in particular, and the Asian continent in general, were the so-called ‘great global landfills’ for decades, as they were the biggest recipients of solid waste of all kinds, despite having very little infrastructure for the recovery of these materials.

In addition, in the vast majority of cases this waste arrived unprocessed and contaminated, which is why the majority ended up in landfills and incinerations that rapidly deteriorated the air quality and the health of the countries’ inhabitants (especially due to the incineration of plastic waste).

This process of importing waste began in the 1980s, when manufacturing activity exploded in the country. The demand for raw materials grew disproportionately and the doors were opened to this solid waste import system as a means to obtain new raw materials.

In a surprising decision, in 2017 China decided to gradually close its borders to this waste, including paper and cardboard, until on 1 January 2021 the country banned all solid waste imports entirely.

It is estimated that in 2017 China received almost half of the world’s recycling. If we also factor in the increase in its own production of solid waste, the Asian giant’s environmental problem is of an incalculable magnitude.

This decision to close the borders to waste destabilised the recycling chains of half the world and led to one of the largest increases in the price of raw materials, as Chinese paper companies were over-supplied in December 2020 before the measure became 100% effective.

Since this date it has not been possible to export solid waste to China, only processed paper pulp. Industry experts forecast an upward trend in Chinese pulp and paper demand until at least 2023.

Paradoxically, the country that invented paper has not developed an important industry around this raw material, for reasons such as the scarcity of forest resources, low import costs compared to manufacturing costs, the higher quality of paper from other countries compared to local paper, etc.

As a result ENCE, the leading European producer of eucalyptus pulp, announced at the beginning of 2021 that it had already sold all of its 2021 production and that it anticipated a race to the rise in prices due to Chinese imports that already represent 40% of global demand. This very high demand goes hand in hand with the excellent sales performance of Chinese goods abroad, especially with regard to medical and technological devices.

NEW LIFESTYLE AND HYGIENE HABITS AFTER COVID-19

In 2019, digitisation was causing an unstoppable decline in demand for writing and printing paper (books, magazines, newspapers, etc.).

But, as we well know and have read in numerous articles, COVID-19 has brought about a change in lifestyle habits, accelerating e-commerce growth with its consequent demand for cardboard for packaging.

New hygiene habits have also led to a growth of paper products destined for the sanitary and personal hygiene market.

Add to all this the restrictions on single-use plastic products that have now become paper products (cups, plates, bags, etc.).

Therefore, the increasing demand for this material can be explained, although the growth of the different types of paper is not the same. Leading the way is paper for corrugated cardboard, followed by paperboard and pasteboard for other types of packaging. Cellulose paper follows and behind that are graphic paper and special papers.

GROWING SUSTAINABILITY AWARENESS

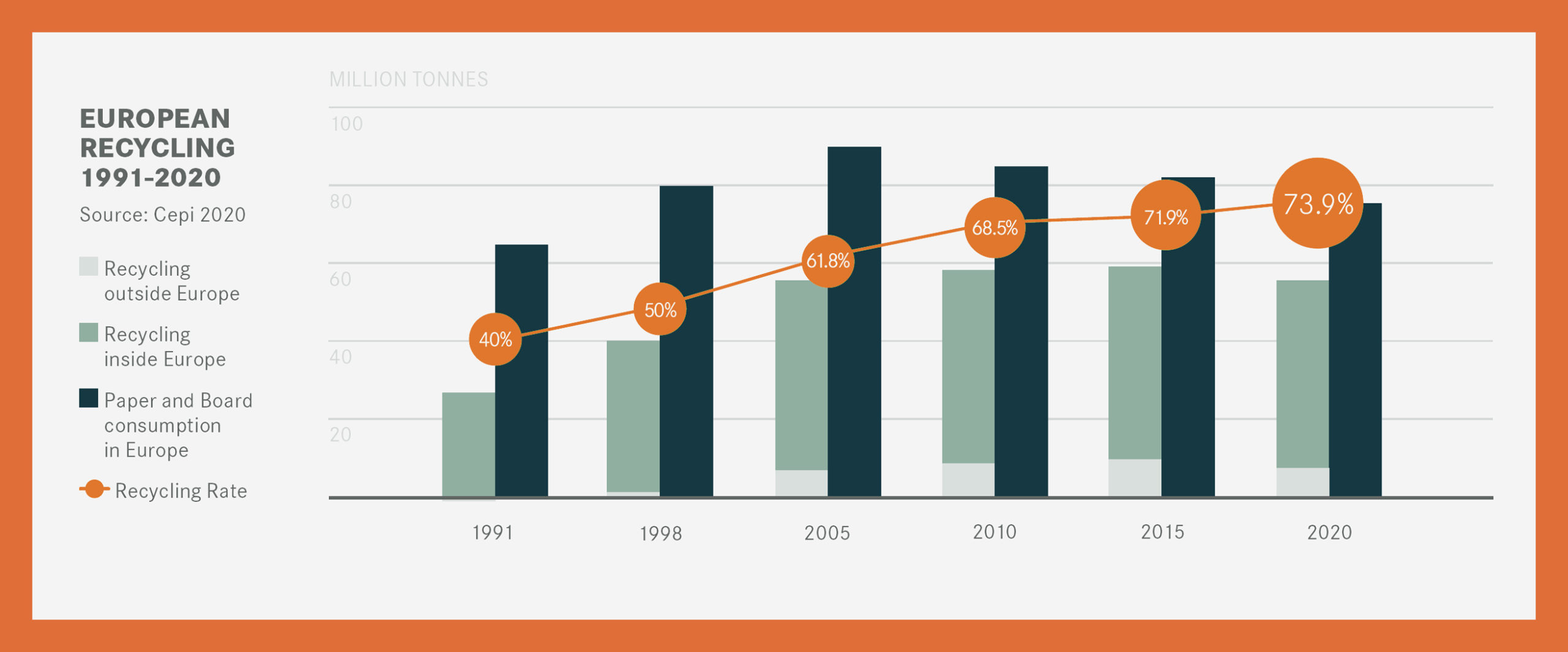

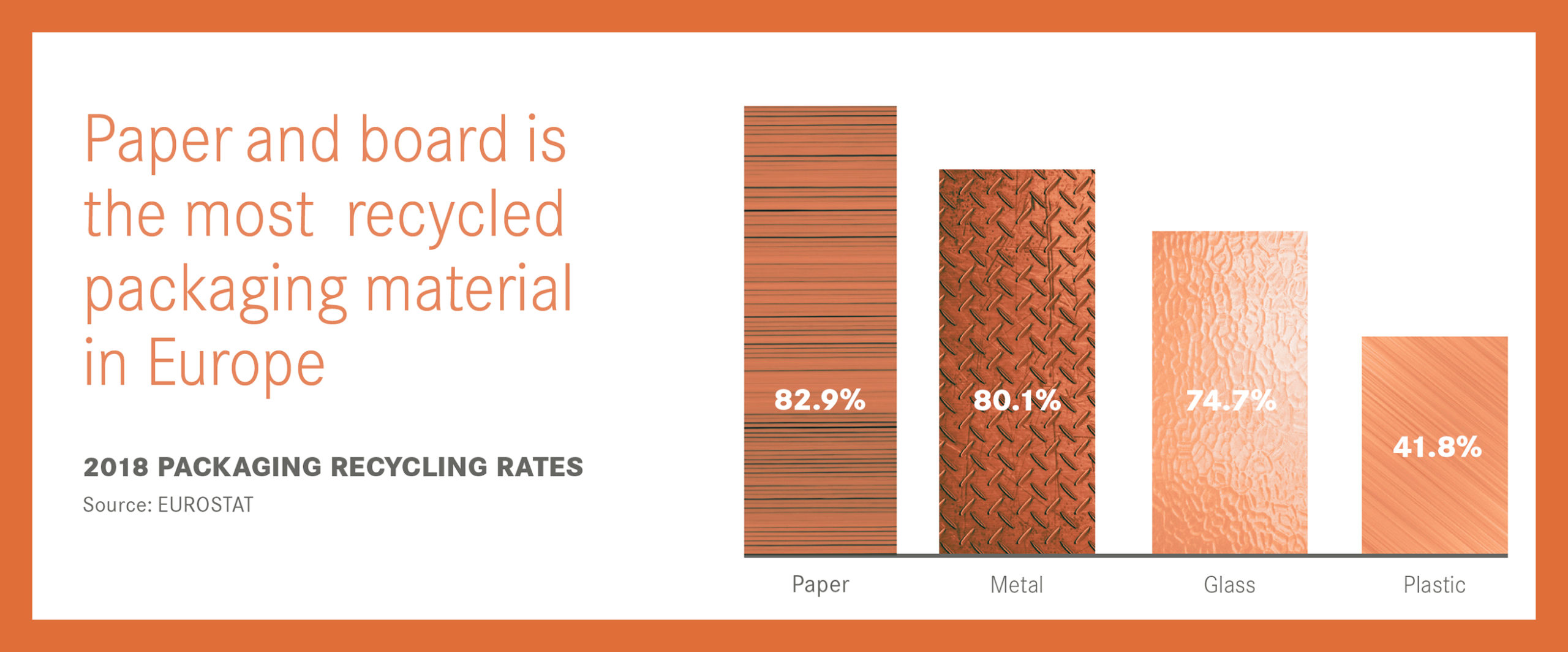

If there is any material that enjoys a good reputation when it comes to sustainability and the environment, it is paper and cardboard.

This is partly because paper is a very old material and throughout history there have been different trials and case studies on its recycling, although not industrially.

In 1800, the English paper manufacturer Matthias Koops patented a novel procedure to ‘extract the dye from paper and convert this paper into pulp’.

Other much more modern materials such as plastic, whose mass use did not begin until after the Second World War, did not have advanced recovery technologies from the get-go.

We must keep in mind that worldwide we are all at the ‘start-up’ stage as far as circular economy is concerned; only the paper industry has a little more experience with this.

Paper and cardboard are biodegradable, colour-fast and infinitely recyclable materials. Most of us are aware of the circular economy scheme that paper follows and, for all this, it has become ‘The Material’.

After agreements to reduce single-use plastics were reached, technology was put at the service of paper to offer us all kinds of products, and the constant publications on new research tell us that all this has only just begun: microcellulose, nanocellulose, green chemistry concepts, water-based barrier coatings for food packaging, coatings that provide functional properties such as anti-corrosion, antimicrobial, etc.

Therefore, we have a material, paper and cardboard, which is golden, but we cannot afford to drop our guard: the objectives needed to reach optimal levels of circularity are still very demanding.

In 2019 4evergreen was created, a European initiative that succeeded the EDPR (European Declaration on Paper Recycling 2010–2015). It is a highly ambitious initiative throughout the entire value chain, and its aim is very clear: to improve circularity in each and every one of the stages of the packaging life cycle, based on the following core ideas:

- Innovation in packaging development.

- Innovation in functionality.

- Improvement in recycling systems to reach 100% of the potential offered by circular economy.

One of its main goals is to achieve 90% of recycled paper and cardboard across Europe by 2030, and its tactics to achieve this are the following:

- A comprehensive guide to waste collection and separation.

- Promoting eco-design.

- Research and development.

- Education and information.

Therefore, sustainability culture, the levels of circularity already achieved and the material’s inherent characteristics justify and sustain the high demand and fluctuation in prices.

In short, paper and cardboard continue to be an accessible material that is highly adaptable to a myriad of needs and solutions, and the best thing is that there is still a wide margin of innovation for it to continue being one of the most sustainable materials out there today.

But don’t use it as a ‘conscience cleaner’, there is a lot of innovation, technology, design and management that can be applied to it to improve its levels of circularity.